Canada’s unproductive funds

After speaking lots about how we actually—lastly—must get critical concerning the decades-long concern of Canadian productiveness decline, the federal authorities determined that maybe it wasn’t such an enormous precedence in any respect.

Tuesday’s federal funds had a number of modifications in it, and MoneySense’s columnist and Licensed Monetary Planner Jason Heath has a superb breakdown of how the 2024 federal funds would possibly have an effect on you and your funds.

However for the needs of commenting on Canada’s productiveness, we’ll focus solely on the modifications to the taxation of capital positive aspects. Till Tuesday’s announcement (which takes impact in 10 weeks) solely 50% of a capital acquire was included as taxable earnings in your annual tax return. That inclusion price will now be 66.67% for capital positive aspects inside companies and trusts. For people, the brand new inclusion price might be utilized to all capital positive aspects over the $250,000 threshold annually.

Just a few transient factors for consideration on who these new taxes guidelines would possibly have an effect on:

- This authorities has actually cracked down on profitable enterprise house owners who’re utilizing their companies to shelter investments from taxation. First it was the 2018 modifications round earnings splitting and passive earnings thresholds, and now we see capital positive aspects hikes as nicely.

- Only a few Canadians can pay this elevated capital positive aspects inclusion price year-in and year-out. The $250,000 threshold is a comparatively excessive one, and that is the image that Finance Minister Chystia Freeland desires to color when she talks concerning the “0.13%” who might be affected.

- Nonetheless, a good variety of Canadians might be impacted by this new capital positive aspects inclusion price within the 12 months they go away. Canadians who personal a cottage, a rental property or properties, and/or giant non-registered funding accounts are fairly prone to have greater than $250,000 in capital positive aspects on their closing tax returns.

- There might be a considerable variety of Canadians who rush to “get in beneath the wire” over the following few weeks and understand capital positive aspects on the outdated 50% inclusion price. Some are suggesting that these capital positive aspects will possible be “pulled ahead” from the following few years and can lead to a one-time income increase for Ottawa.

Whereas affordable individuals can disagree on who ought to shoulder the next tax burden and what’s thought of a “fair proportion” in Canada, there isn’t a doubt that these new taxes will proceed to discourage funding inside our nation. (Learn: How will the modifications to capital positive aspects in Canada have an effect on tech sector?) It’s additionally a part of a funds that added considerably extra complexity to our already-too-complex tax code. The sheer issue of calculating your taxes and making an attempt to plan for long-term tax effectivity in Canada is yet one more drag on productiveness.

Former finance minister Invoice Morneau was politely scathing in his commentary on the brand new modifications, saying: “This was very clearly one thing that, whereas I used to be there, we resisted. We resisted it for a really particular motive—we had been involved concerning the progress of the nation… I don’t assume there’s any approach to sugar coat it. It’s a problem. It’s in all probability very troubling for a lot of traders.”

The frenzy to boost taxes versus discovering efficiencies in present authorities spending is a troublesome tablet to swallow for a lot of, particularly in gentle of the exploding numbers of public workers in Canada.

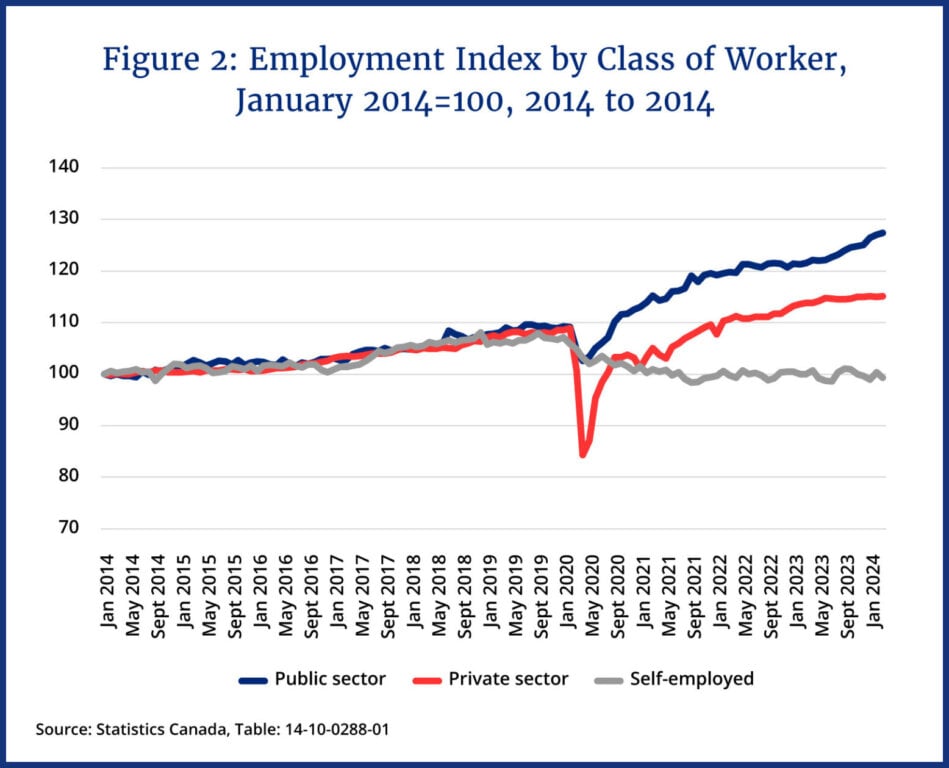

From the chart above, it doesn’t seem that Canadians had been missing for causes to not begin their very own companies or spend money on modern progress.